FEAR AND GREED AS A TRADING PHENOMENON

PUBLISHED: 2025-07-01

CATEGORY: Knowledge Base

Fear and greed emotions play the key role in trading. These emotions make markets move and create volatility. That is why it is so important to not only know how these emotions influence the price movement, but also to control your emotions to excel in trading results.

This article explains the behavior of emotionally driven traders and gives some insight to the problem of overreaction.

Psychology behind buy when everyone is fearful and sell when everyone is greedy

The psychology of trading underscores that while technical analysis and market knowledge are crucial, they are only part of the equation. The human element - emotions, biases, discipline, and mindset - plays a pivotal role in how trading strategies are executed. Mastery over one's psychological responses to the markets can be as, if not more, important than any trading algorithm or strategy.

For traders, the journey is as much about understanding oneself as it is about understanding the market. By recognizing and managing the psychological aspects of trading, one can navigate the volatile waters of financial markets with greater resilience and potentially, success.

I think you pretty much all know this saying by Warren Buffett, who once said that it's wise for investors “to be fearful when others are greedy and to be greedy only when others are fearful.”

This statement is somewhat of a contrarian view of stock markets that relates directly to the price of an asset. When others are greedy, prices typically boil over and one should be cautious lest they overpay for an asset that subsequently leads to anemic returns. It might present a good value investment opportunity when others are fearful.

I should add, however that this wisdom should be taken with a grain of salt. You cannot apply it anytime in the market, rather when there is a clear uptrend otherwise you will keep buying the dip which drops more and more in time.

That is why in crypto we trade by seasons that consist of roughly 4 years, where one of four is winter, which can be called a downtrend. As soon as we move to spring the rule can be applied.

It is also common for people that have been trading for a while to feel their gut, that is if you feel yourself uncomfortable when there is a rapid selloff, then it is usually the time to buy. On the other hand, when your portfolio rises with a speed of light, pros feel uncomfortable to sell, again this is the right time to at least sell some part.

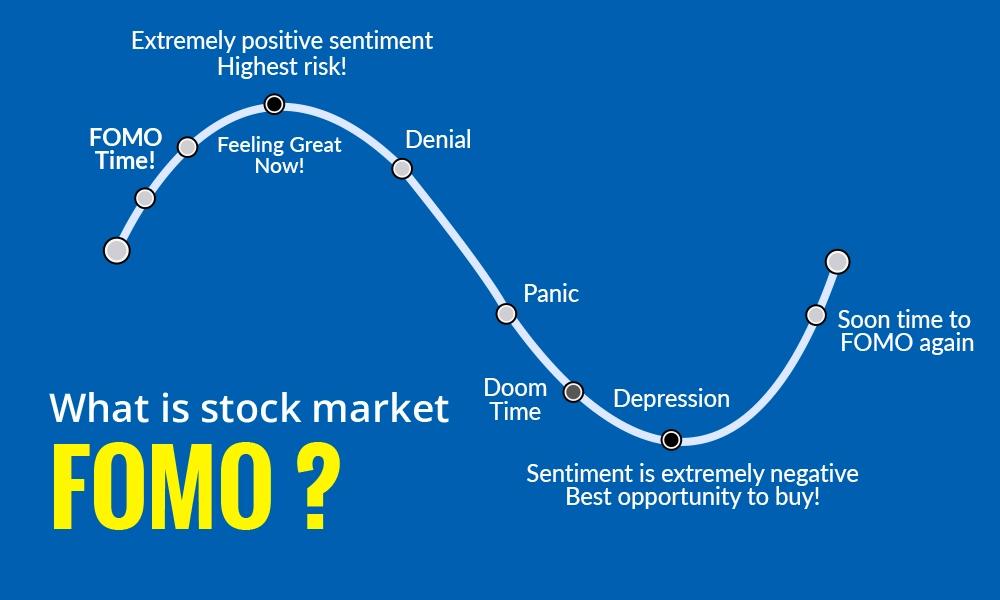

Markets are driven by human emotions. Greed and fear are two of the most powerful forces in financial markets. When the market is booming, greed overtakes investors; euphoria spreads, and people often throw caution to the wind, buying at any price. Conversely, during downturns, fear grips the market, leading to panic selling, where assets are sold at depressed prices.

Greed: When everyone is buying, asset prices often inflate beyond their intrinsic value due to speculative bubbles. This is the time when investors should be cautious, practicing skepticism rather than succumbing to the fear of missing out (FOMO).

Fear: In contrast, when markets are down, and pessimism prevails, high-quality assets can be found at bargain prices. Here, the contrarian investor sees opportunity where others see only risk.

Why fear presents unique buying opportunity

Fear in financial markets often presents a unique opportunity for investors to buy assets at lower prices for several compelling reasons:

Asset Undervaluation:

When fear dominates the market, investors tend to sell off assets quickly, often without regard to their fundamental value. This can lead to a significant drop in prices, making stocks, bonds, or other investment vehicles undervalued. Savvy investors can then purchase these assets at a discount, anticipating a recovery in value once rational assessment returns to the market.

Overreaction to News or Events:

Markets can overreact to negative news or events, leading to an exaggerated decline in asset prices. If the fundamentals of a company or market remain strong or if the event's impact is less severe than initially feared, the price correction can be an overcorrection. Buying during such times means you're potentially getting in at a price that will rebound over time.

Overreaction to News or Events:

Fear often leads to panic selling, where investors liquidate positions to avoid further losses, regardless of the intrinsic worth of their investments. This behavior can create bargains, especially in quality assets or in sectors that are temporarily out of favor but have strong long-term prospects.

Contrarian Investment Strategy:

The principle of "be greedy when others are fearful" (a famous Warren Buffett adage) suggests that going against the crowd during times of market fear can yield high returns. When everyone is selling, there are fewer buyers, which can lead to excellent buying opportunities for those who can remain calm and analytical.

Market Sentiment Reversal:

Markets are cyclical, and sentiment shifts from fear to greed and back again. Buying when fear is at its peak positions an investor to benefit from the subsequent recovery. Historical data shows that after significant market downturns, there's often a robust recovery phase, rewarding those who bought during the nadir.

Reduced Competition for Assets:

During fearful times, many investors retreat to cash or safer havens, reducing competition for stocks, real estate, or other investments. This can lead to better deals for those still willing to invest, as there are fewer buyers driving up prices.

Quality Assets at Lower Prices:

Fear can push even high-quality assets into a bear market. Companies with strong balance sheets, good cash flows, and solid business models might see their stock prices drop alongside weaker companies, offering a chance to invest in top-tier businesses at a fraction of their usual cost.

Long-term Perspective:

Investors with a long-term view understand that while markets can be volatile in the short term due to fear, over decades, markets tend to grow. Buying during fear allows for accumulation at lower prices, potentially leading to significant gains in the long run.

Emotional Discipline Pays Off:

Investing when others are fearful requires emotional discipline, patience, and a contrarian mindset. Those who can manage their emotions and resist the fear-driven urge to sell can benefit greatly when markets recover.

However, it's crucial to approach buying during times of fear with caution:

Due Diligence: Fear might be justified if there are genuine fundamental issues with an asset or market. Therefore, thorough analysis is necessary to distinguish between temporary fear and real, long-term risks.

Risk Management: Even if buying during market fear, diversification and risk management strategies should be in place to protect against further unforeseen downturns.

Market Timing: Perfect timing the bottom of the market is nearly impossible. Thus, a strategy might involve dollar-cost averaging into the market during a downturn rather than trying to buy at the absolute lowest point.

In summary, fear can indeed be an excellent opportunity to buy, provided one approaches it with a clear strategy, understanding of market dynamics, and a focus on long-term investment value rather than short-term market noise.

Greed in the markets is a strong signal to be cautious

Greed in the context of financial markets often signals that it might not be the best time to buy assets for several reasons:

Overvaluation:

When greed is prevalent, asset prices are often driven up beyond their intrinsic value. Investors might be willing to pay more than an asset is fundamentally worth, expecting prices to keep rising. This can lead to buying at the top of a market bubble, which is risky if the bubble bursts.

Speculative Bubbles:

Greed can fuel speculative bubbles where the price of assets like stocks, real estate, or cryptocurrencies rises rapidly due to speculation rather than underlying value. Buying into these bubbles late can mean paying peak prices, with the potential for significant losses if the bubble pops.

Herd Mentality:

Greed often leads to herd behavior, where investors buy what everyone else is buying, often without proper analysis. This can inflate demand artificially, leading to overbought conditions and market corrections when the enthusiasm wanes.

Increased Competition:

With many investors chasing the same opportunities due to greed, competition for assets increases, driving up prices further. This can mean less favorable entry points for new buyers, reducing potential returns.

Neglect of Fundamentals:

In a greedy market, there's a tendency to ignore traditional valuation metrics like P/E ratios, cash flow analysis, or debt levels in favor of momentum investing. This neglect can lead to buying into companies or assets that are fundamentally weak or overleveraged.

High Expectations for Returns:

Greed can set unrealistic expectations for returns, leading investors to take on excessive risk or to invest in highly speculative ventures without a clear understanding of the risk-to-reward ratio.

Market Sentiment at Peaks:

When greed dominates, it often means market sentiment is at or near its peak. Historical market cycles show that after periods of intense greed, there's usually a correction or a bear market, where asset prices fall back to more realistic levels.

Increased Leverage:

Greed can encourage the use of leverage (borrowed money) to invest more than one's equity would allow. While this can amplify gains in a rising market, it significantly increases losses if the market turns, leading to margin calls or forced selling.

Lack of Bargains:

During times of greed, finding undervalued or bargain-priced assets becomes much harder. Most assets are priced at or near their perceived maximum value, reducing the margin of safety for new investments.

Psychological Impact:

Buying when greed is high can lead to emotional decision-making. If the market corrects soon after, investors might face not only financial losses but also psychological stress from buying at or near the peak.

Potential for Sharp Reversals:

Greed can lead to sharp, rapid price movements. If sentiment shifts, these movements can reverse just as quickly, catching latecomers in a downward spiral.

Misallocation of Resources:

In a greed-driven market, capital might be misallocated towards overhyped sectors or assets, potentially neglecting areas with more sustainable growth or value.

While greed can be a signal to take profits or rebalance a portfolio, it's generally not the optimal time for aggressive buying unless one is employing a contrarian strategy with a long-term perspective. For those looking to invest during periods of market greed, caution, thorough due diligence, and a focus on asset quality over price momentum are essential. Moreover, strategies like value investing might be more prudent, seeking assets that are still undervalued or have strong fundamentals despite the overall market euphoria.

Conclusion

First of all, you should understand that everything above can be used when market is in uptrend or in other words, there is a period if bull markets. Bull markets usually happen when rates go down and government prints money to support economy, ISM index gets above 50 from lower levels.

In such conditions you can apply the rules that are described in the article.

Disclaimer: This statement does not constitute financial advice. The information provided is for informational purposes only and should not be considered as investment advice. If you require financial advice, please consult with our certified financial consultants who can offer personalized guidance based on your specific financial situation.

#fear #greed #trading #psychology

COMMENTS • 2

John 2025-01-08 | 00:57:59

We really need to control our emotions, and in this way we can achieve good trading results.

David Kohh 2025-01-08 | 17:01:39

Actually now we are facing such times that emotional control is so important. I've been trading crypto for about a year and always try to buy when everything rises and the regret of doing so. Then when markets move down fast, I try to sell not to loose my profit. So I end up with loosing the profit and not getting the good prices at the first place. But it is really hard to do otherwise.