CRACKUP BOOM OR GLOBAL MELT-UP

PUBLISHED: 2025-09-19

CATEGORY: Market Analysis

A crack-up boom is an extreme economic scenario where hyperinflation and currency devaluation spiral out of control, leading to a frenzied rush to spend money before it loses all value. Now economy is not in this phase, however some trends and features are already present. How can we hedge ourselves against this phenomenon and how close we are to such scenario?

This article tires to examine the notion and provide some guidelines on how to preserve wealth and keep up with inflation trying to get ahead of inflation and currency devaluation.

Executive Summary

This memo evaluates cryptocurrency markets through the lens of macro liquidity, market structure, on-chain behavior, and social participation. The goal is not to forecast near-term price action, but to assess risk asymmetry and determine whether current conditions justify increased exposure.

Bitcoin peaked in Q4 2025, consistent with every prior post-halving cycle. However, unlike 2017 or 2021, this cycle topped on apathy rather than euphoria. Retail participation, speculative breadth, and social engagement never reached historically elevated levels, even as Bitcoin made new highs. This structure closely resembles mid-2019, when Bitcoin rallied sharply without igniting broad speculation.

Importantly, apathy-driven peaks do not necessarily lead to deeper or longer bear markets than euphoric peaks. In 2019, Bitcoin’s drawdown phase was shorter than the approximately twelve- month declines that followed the euphoric peaks of 2017 and 2021. However, apathy-driven declines tend to be choppier and more uneven, characterized by repeated countertrend rallies rather than a single capitulation.

Macro conditions currently reinforce caution. The economy shows signs of cooling, but remains resilient enough to limit aggressive liquidity expansion. As a result, the broader risk-reward profile for crypto remains skewed toward capital preservation rather than expansion.

Taken together, the evidence suggests the market is in a post-cycle digestion phase, similar to 2019. Rallies are likely, and select assets may perform well, but structural upside remains constrained until liquidity, participation, and on-chain conditions reset.

Apathy vs Euphoria — Why This Cycle Topped Differently

Previous Bitcoin cycle peaks were driven by widespread speculation, rapid retail inflows, and expanding social engagement. In 2013, 2017, and 2021, price advances were reinforced by surging participation across exchanges, social platforms, and alternative cryptocurrencies.

The 2025 peak was fundamentally different. Despite Bitcoin reaching new all-time highs, measures of social and speculative participation remained muted. A composite Social Risk Index constructed from content consumption, exchange activity, and crypto-related social discourse shows that engagement was near historical lows relative to price.

This divergence between price and participation is the defining feature of an apathetic market top. In such regimes, price advances are driven primarily by a narrow pool of capital, typically institutional and systematic flows, rather than expanding marginal demand. Without a growing base of buyers, rallies become structurally fragile.

This pattern closely resembles mid-2019, when Bitcoin rallied sharply from the 2018 lows but failed to generate a speculative boom across the broader crypto ecosystem.

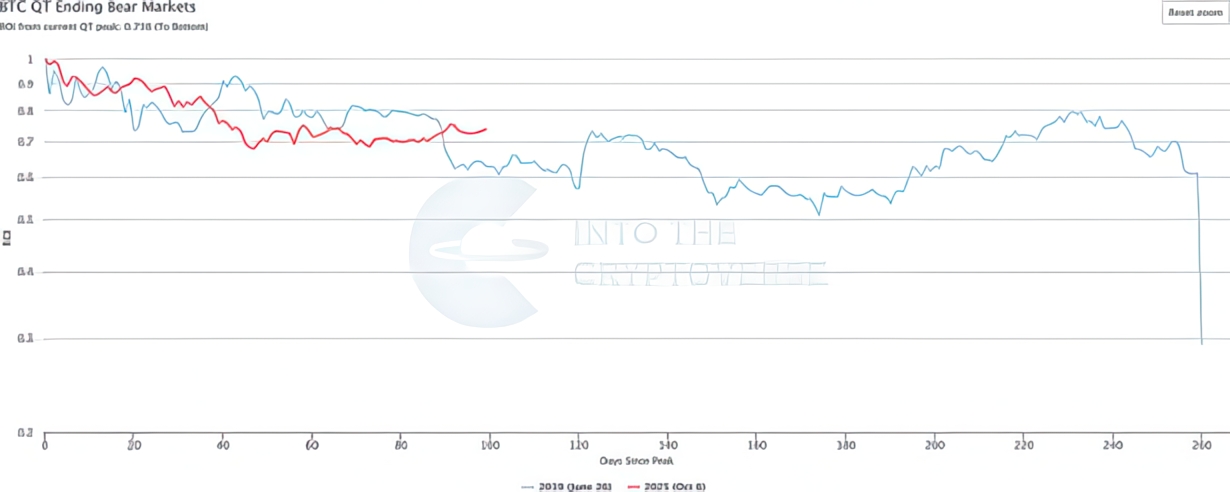

Bitcoin peaked in early October 2025. Quantitative tightening ended in early December 2025. This sequence closely mirrors 2019, when Bitcoin peaked in late June and tightening ended on August 1st.

In both cases, Bitcoin topped before monetary policy stabilized, and prices continued to weaken even after tightening ended. Bitcoin has often led macro liquidity turning points rather than responding to them.

Bitcoin’s market-cycle duration closely matches prior cycles when measured from bear-market lows.

The October 2025 peak fits squarely within this historical rhythm, reinforcing the view that the cycle has transitioned from expansion to distribution.

CYcle-relative metrics

Calendar-based returns are misleading early in the year. Cycle-relative metrics provide a more accurate view of risk. Once Bitcoin peaks, it historically enters a prolonged erosion phase, even when monetary policy begins to ease. This was evident in 2019 and appears to be unfolding again. The similarity between the current drawdown path and 2019 reinforces the view that this cycle peaked on apathy rather than speculative excess.

Historically, when Bitcoin enters a post-peak drawdown regime, the distribution of forward returns becomes asymmetrically unfavorable. Upside tends to be capped by overhead supply as long-term holders continue to distribute into rallies, while downside remains open in the absence of sustained marginal demand. This dynamic is why post-cycle recoveries often fail: price may rise temporarily, but without broad participation and liquidity expansion, rallies encounter structural selling pressure rather than fresh buying.

If we compare BTC drawdown from the 2025 peak with 2019 we get the following picture.

Rolling one-year returns compress after peaks and rebuild only after deep, time-consuming bottoms. While no two cycles are identical, both mid-2019 and the current period share the same defining structural features: narrow leadership, weak social participation, and tightening liquidity into the peak — conditions that historically produce extended capital-erosion phases rather than durable recoveries.

On-Chain Risk and Holder Behavior

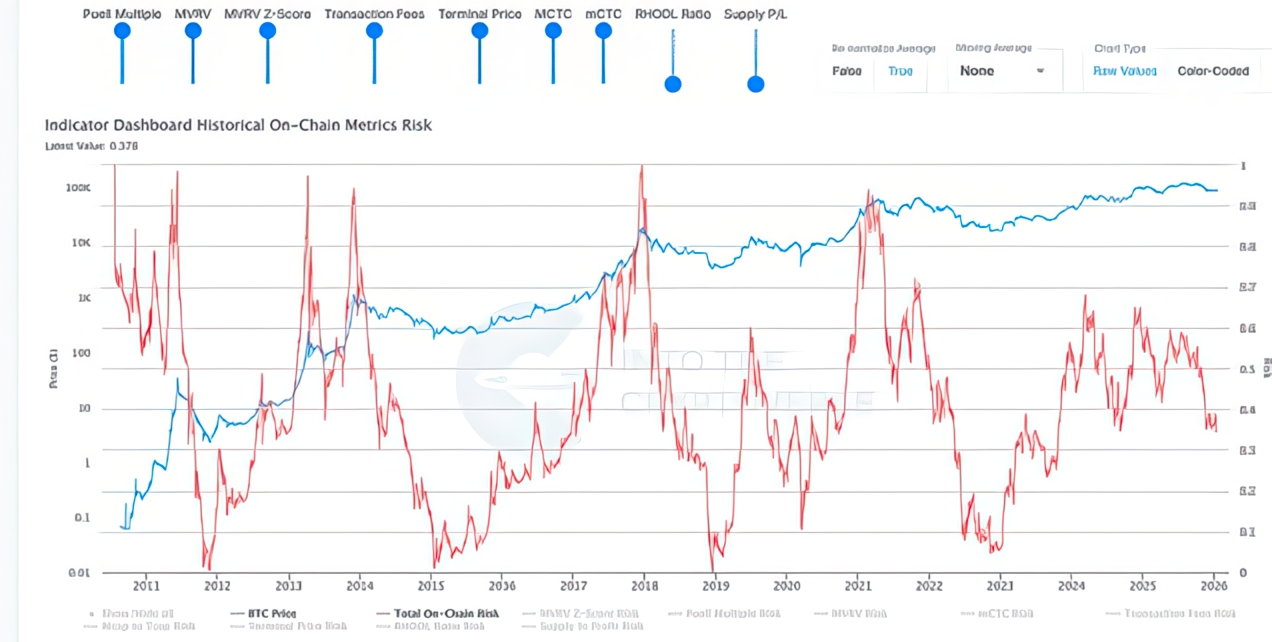

The on-chain risk model aggregates multiple structural indicators of Bitcoin’s internal market health into a single composite regime signal. These inputs include valuation measures (such as realized price, cost basis dispersion, and profitability), investor behavior (long-term holder spending, coin age distribution, and dormancy), and network activity (transaction flows and supply turnover).

Rather than attempting to identify exact tops or bottoms, the model is designed to detect risk regimes, or periods when marginal upside becomes limited relative to downside, and periods when downside risk has been largely exhausted.

During speculative peaks, the model typically moves into euphoric territory as profit-taking, leverage, and supply turnover all rise together. That pattern was visible in 2013, 2017, and 2021.

In the current cycle, however, the model never reached euphoric levels. This indicates that Bitcoin did not top due to overheating, but rather due to demand exhaustion. Prices rose without a commensurate increase in speculative intensity, leaving the market vulnerable once inflows slowed.

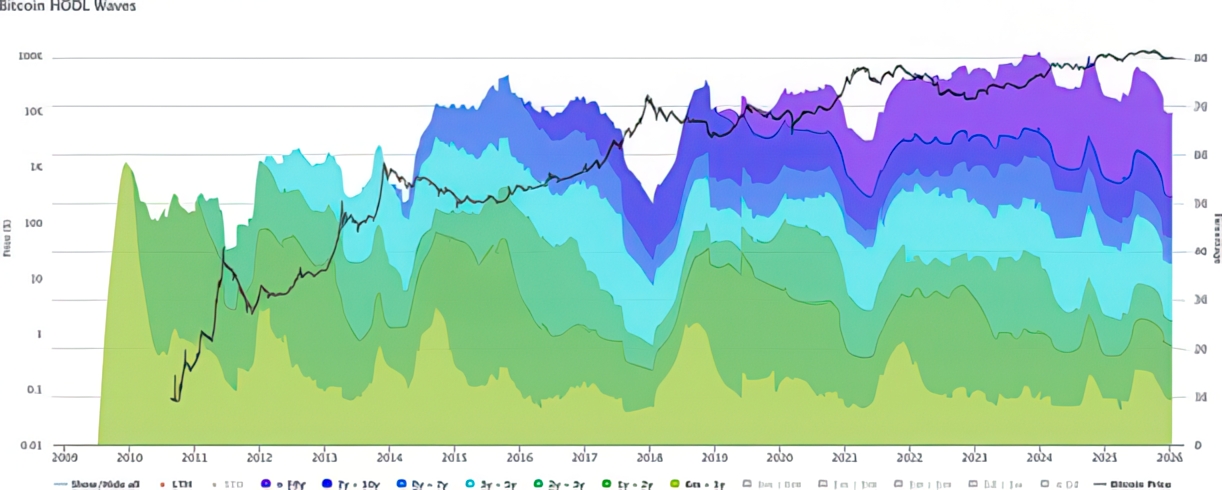

This is consistent with what is observed in the HODL waves. Long-term holders, who tend to be the most informed and least reactive participants, have been distributing into strength rather than accumulating. Historically, this behavior appears after market-cycle peaks, when risk-adjusted returns deteriorate and experienced investors shift from accumulation to capital preservation.

Taken together, the on-chain risk model and holder behavior confirm that Bitcoin is operating in a late-cycle regime characterized by distribution rather than accumulation.

Market Internal Health and volatility

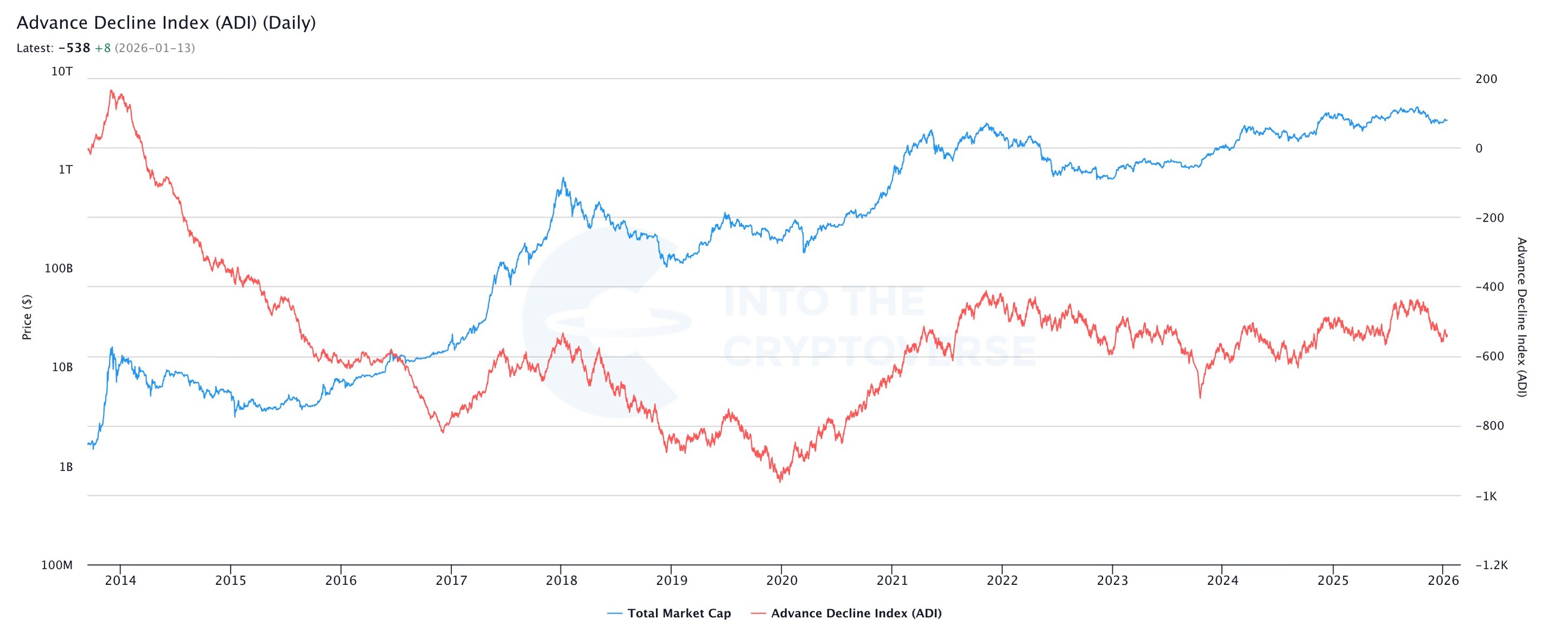

The advance-decline index reveals the internal health of the crypto market by tracking how many assets are rising versus falling. During healthy bull markets, advances are broad-based: capital flows across large-cap and small-cap assets alike, indicating expanding risk appetite and a growing speculative base.

The current cycle displays the opposite. Even as Bitcoin reached new highs in 2025, the majority of crypto assets failed to participate. The advance-decline index trended downward, indicating that most assets were declining beneath the surface. This divergence between index-level price and market internals is a classic late-cycle signal across financial markets.

Weak breadth reflects a breakdown in speculative demand. Capital has concentrated in a small number of perceived “safe” assets rather than dispersing throughout the ecosystem. That behavior is consistent with risk-off positioning rather than risk-on expansion.

Bitcoin dominance has risen structurally as capital migrated away from smaller and more speculative crypto assets. Rising dominance indicates a defensive posture: investors are choosing the most liquid, most established asset while abandoning the periphery. When breadth fails, it is not because assets are weak, it is because risk appetite is exhausted. Breadth collapses not when price is high, but when marginal buyers are gone.

The modest decline in Bitcoin dominance following the October 2025 peak does not indicate a revival of altcoins. It reflects Bitcoin falling faster than already-depressed alternative assets. This is the same phenomenon observed in 2019 after Bitcoin’s mid-year peak.

Taken together, weak breadth and rising dominance indicate that the crypto market is no longer in an expansionary phase. Capital is retreating inward rather than outward, a hallmark of late-cycle and post-peak regimes.

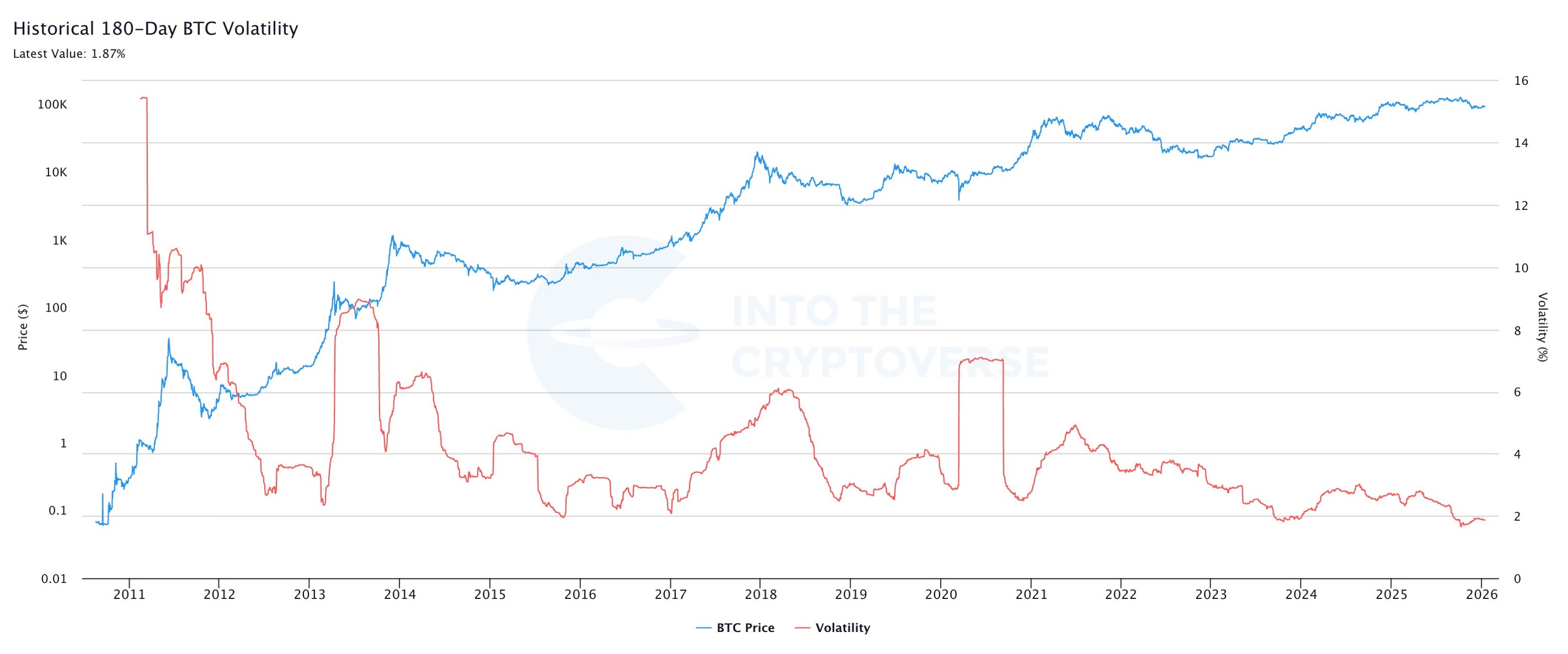

Sustained volatility compression following a multi-year advance reflects declining participation and risk appetite. Historically, this environment precedes either sharp repricing or extended periods of stagnation, not renewed bull markets.

Low volatility at cycle highs is not stability, but rather fragility.

Macro and Liquidity Constraints

Crypto markets are governed not by the absolute quantity of liquidity, but by the availability of speculative liquidity, capital that is both abundant and willing to take risk.

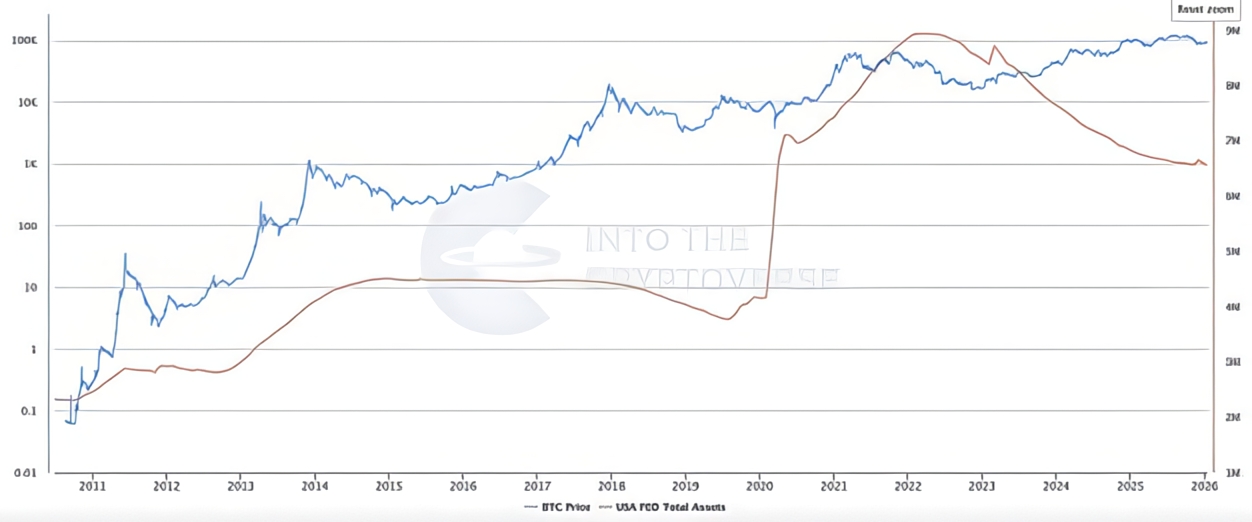

While the Federal Reserve’s balance sheet has begun to expand again, the character of that expansion matters. The recent increase appears consistent with reserve management, funding operations, and financial-system stabilization rather than the crisis-driven or stimulus-driven quantitative easing that has historically created excess speculative capital. In prior crypto bull markets, liquidity expanded because policymakers were forced to respond to acute economic or financial stress. That condition is not yet present.

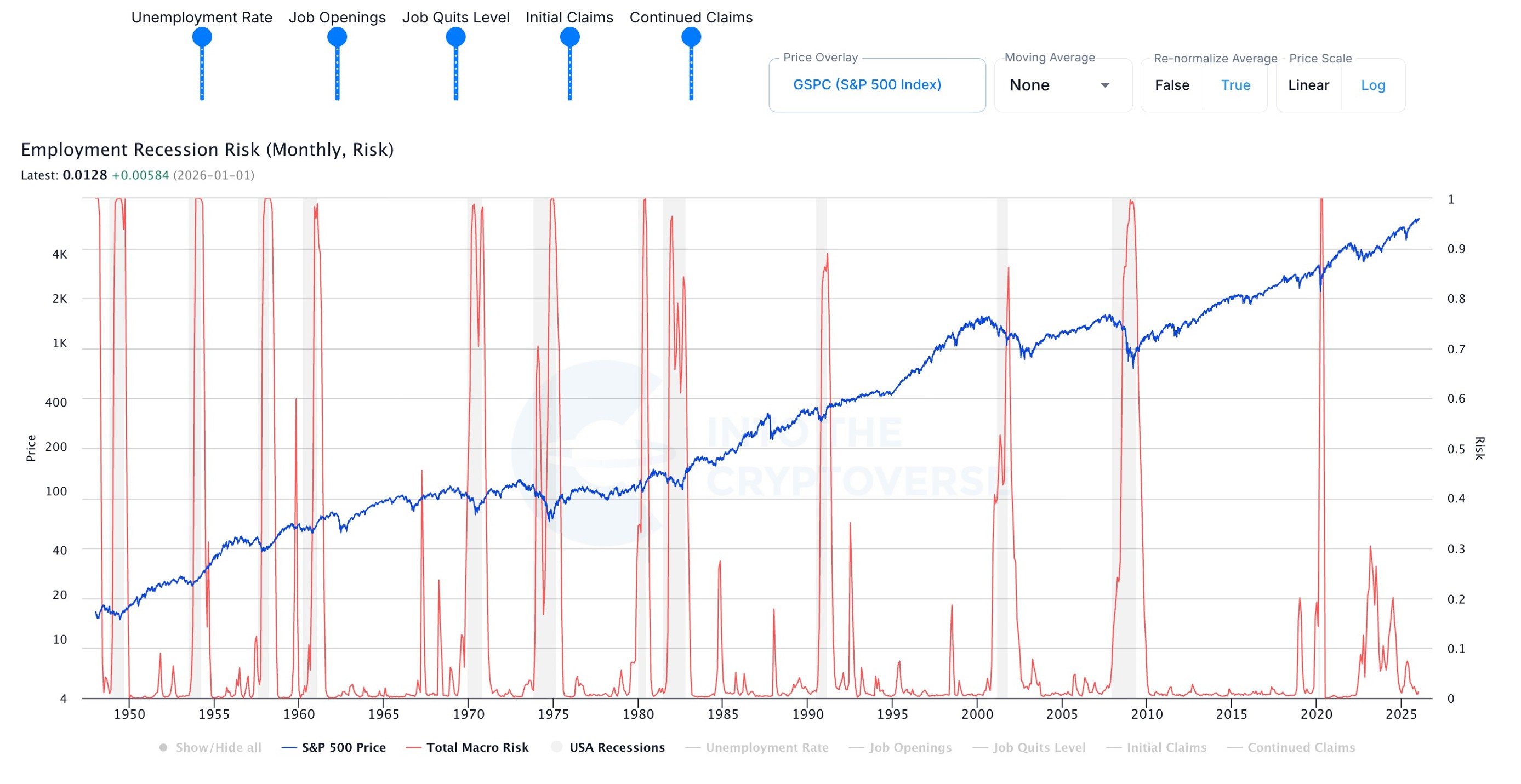

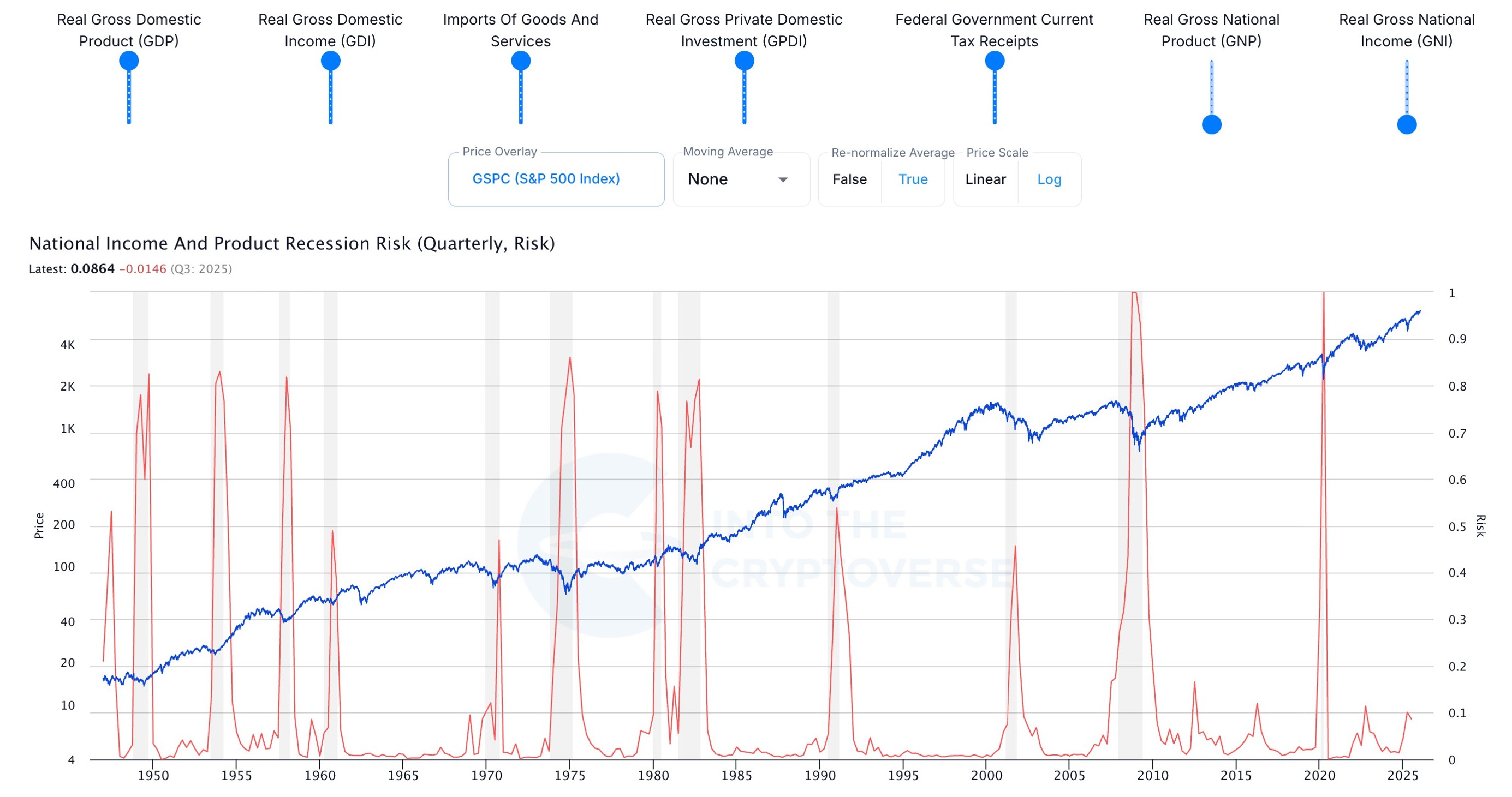

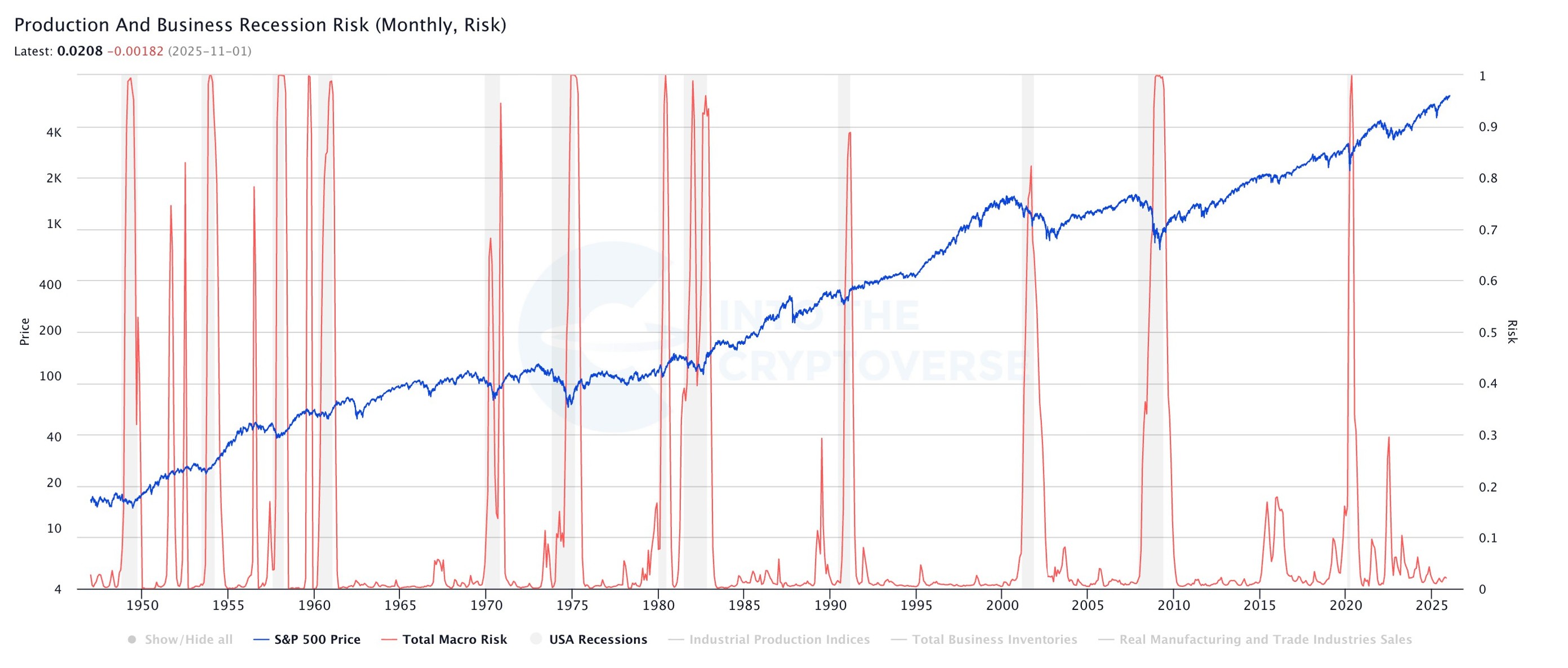

This distinction is reflected in current recession-risk framework, which currently points to an economy that is cooling but not yet breaking. Employment indicators have softened: job openings, hiring, and quits have declined, and the unemployment rate has trended higher. However, layoffs remain comparatively low. This matters because recessions typically do not begin with slower hiring, they begin when layoffs accelerate. The labor market has not entered that nonlinear phase.

The same theme appears in income and production measures. Growth is decelerating, but the data does not yet indicate the type of collapse in household income, business investment, or industrial activity that typically forces emergency-style easing.

This creates a policy environment that is restrictive enough to suppress speculation, but not weak enough to demand aggressive easing. In that regime, liquidity can improve at the margin without becoming the kind of tailwind that typically drives broad-based crypto expansion.

Bitcoin has historically anticipated this dynamic. In 2019, Bitcoin peaked in June while quantitative tightening was still in place and continued falling after tightening ended in August. In the current cycle, Bitcoin peaked in October 2025, roughly two months before balance-sheet contraction ended in December. In both cases, price turned not because liquidity had already tightened, but because marginal speculative demand was exhausted before liquidity turned supportive.

Until recession risk enters a nonlinear phase, marked by rising layoffs, collapsing income growth, or financial instability—the probability of the kind of liquidity expansion that historically drives crypto bull markets remains limited. As a result, macro conditions continue to act as a ceiling on upside rather than a catalyst for a new cycle.

That said, a recession is not strictly required for crypto markets to stabilize and recover. If the labor market continues to cool in an orderly way, with unemployment stabilizing, wage growth moderating, and inflation easing, then monetary conditions could gradually become less restrictive without requiring crisis-level intervention. That environment would not necessarily produce the explosive, liquidity-driven rallies of past cycles, but it could allow Bitcoin and select crypto assets to form a base and begin a more durable recovery. Until that transition becomes visible, however, the macro backdrop remains more supportive of defense than expansion.

Cross-Asset and Metals Context

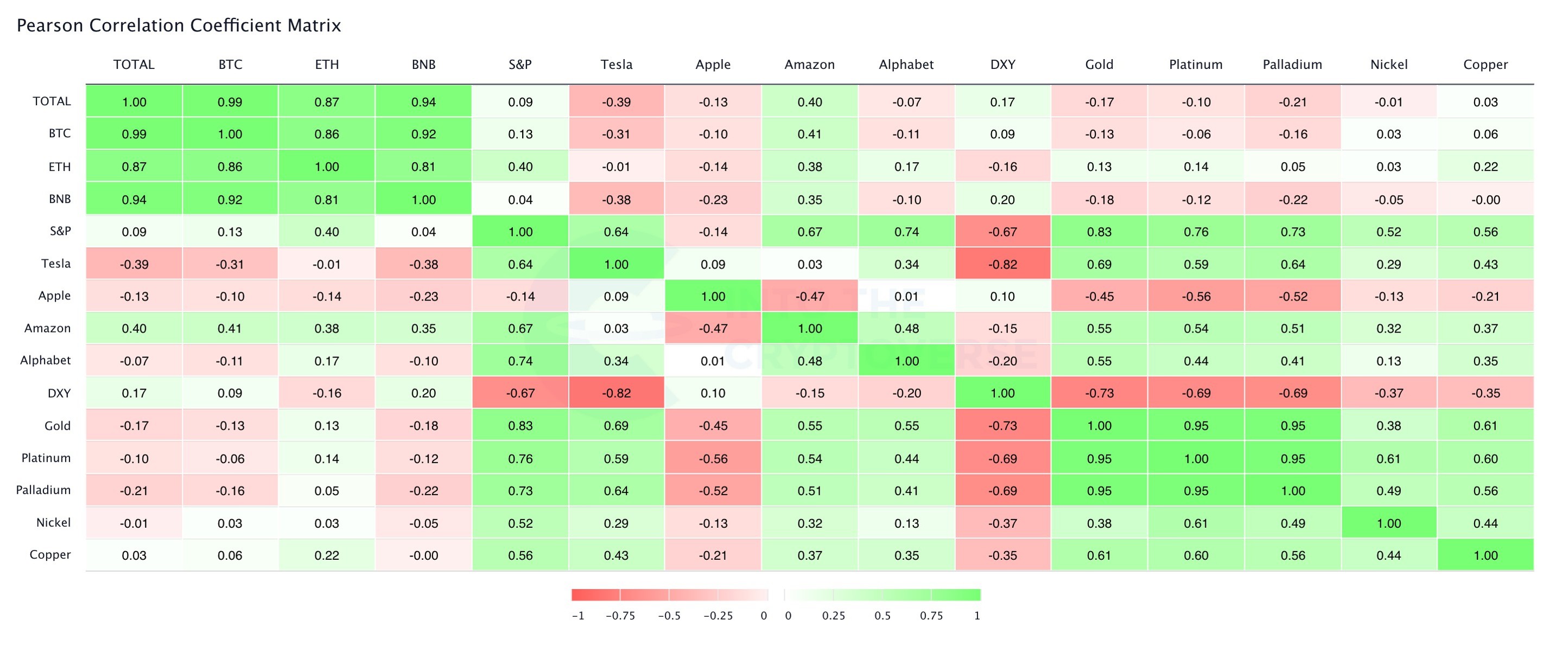

Cross-asset correlations provide important insight into what type of capital is flowing through markets. When crypto is in a bull regime, it typically becomes tightly correlated with other risk assets as global liquidity expands and speculative capital moves indiscriminately across asset classes. When correlations break down, it usually signals segmentation of capital rather than broad risk-on behavior.

The current correlation structure shows a clear regime shift. Bitcoin and the broader crypto complex exhibit weak or unstable correlation with equities, while precious and industrial metals remain tightly linked to macro-driven asset classes. This implies that the liquidity supporting stocks and real assets is not the same liquidity that historically fuels crypto bull markets.

In other words, capital is flowing into assets that benefit from inflation protection, real-asset scarcity, and macro hedging – such as gold, silver, copper, and platinum, rather than into speculative digital assets. This is a classic late-cycle pattern: when risk appetite is constrained, capital migrates toward tangible or defensive exposures rather than high-beta innovation.

The fact that equities have remained resilient while crypto breadth continues to deteriorate reinforces this interpretation. Stocks are being supported by earnings, buybacks, and macro tolerant capital, whereas crypto requires a different type of liquidity: excess capital seeking convex, high-volatility upside. That form of liquidity is currently scarce.

Importantly, this type of decoupling is not unprecedented. A similar divergence appeared in 2019, when equities stabilized and later rallied while crypto continued to digest its post-peak excesses. Correlation breakdowns often occur when crypto is transitioning from a late-cycle distribution phase into a prolonged consolidation phase.

Thus, the current cross-asset structure suggests that crypto is not being left behind by a bull market elsewhere, but rather that it is in a different part of its cycle. Liquidity is present in the financial system, but it is flowing toward assets aligned with macro stability and inflation hedging – not toward speculative digital assets that depend on expanding risk appetite.

This divergence also helps reconcile Bitcoin’s long-term investment thesis with its current cyclical weakness. Bitcoin increasingly behaves like a macro-linked scarce asset over long horizons, which explains why it remains part of the same narrative ecosystem as gold and other real assets. However, crypto markets as a whole still trade on speculative liquidity over cyclical horizons. When inflation-hedging capital flows into metals and equities but speculative risk capital remains constrained, Bitcoin can hold value better than most altcoins while still failing to sustain a full bull market.

In that sense, Bitcoin’s resilience alongside strong metals performance does not signal a new crypto expansion phase – it signals a defensive rotation within digital assets. Investors are choosing scarcity and liquidity over growth and speculation. That is consistent with a late-cycle regime, not the early stage of a new one.

What Would Change This View

This assessment is regime-based and conditional rather than permanent. A materially more constructive outlook would require evidence that the market has transitioned from late-cycle distribution into a new accumulation phase.

Such a transition would likely be accompanied by several converging signals. First, participation would need to broaden materially. This would appear as sustained improvement in advance – decline metrics, rising activity across altcoins, and increasing social engagement, not just price appreciation in Bitcoin alone.

Second, on-chain dynamics would need to reset. That would include an expansion in supply held at a loss, evidence of capitulation by weak hands, and a shift from long-term holder distribution to accumulation. Historically, durable bottoms form when sellers are exhausted and long-term capital begins to rebuild positions.

Third, volatility would need to re-expand in a constructive way. Prolonged volatility compression is characteristic of late-cycle stagnation; regime transitions tend to be marked by rising realized volatility as price discovery returns.

Importantly, this type of decoupling is not unprecedented. A similar divergence appeared in 2019, when equities stabilized and later rallied while crypto continued to digest its post-peak excesses. Correlation breakdowns often occur when crypto is transitioning from a late-cycle distribution phase into a prolonged consolidation phase.

Finally, a decisive shift in macro liquidity would be required. Crypto bull markets have historically emerged not simply when tightening ends, but when liquidity begins to expand in response to economic or financial stress. A collapse in real yields, balance-sheet expansion, or emergency- style policy easing would materially alter the risk–reward profile for digital assets.

Absent these developments, the probability-weighted outcome remains that rallies will be technical rather than structural, and that the broader market will continue to digest the excesses of the prior cycle.

Positioning Implications

Crypto exposure should be tactical rather than strategic. The deterioration in breadth and participation is most acute in altcoins; Bitcoin remains structurally stronger, but even Bitcoin operates within the same liquidity and cycle constraints. Given Bitcoin’s convex payoff profile, maintaining some exposure remains prudent even in unfavorable regimes.

Conclusion

Crypto markets have transitioned into a late-cycle, liquidity-constrained regime. Bitcoin’s October 2025 peak occurred without the participation, leverage, or speculative excess that typically marks durable cycle highs. Instead, it was accompanied by weak breadth, muted social engagement, and distribution by long-term holders, conditions historically associated with market exhaustion rather than renewal.

Macro conditions reinforce this regime. Monetary policy remains restrictive in real terms, and economic activity has not weakened enough to force aggressive liquidity expansion. In prior cycles, crypto bull markets emerged not merely when tightening ended, but when liquidity expanded in response to economic or financial stress. That catalyst is currently absent.

As a result, crypto assets face an unfavorable risk–reward profile. Counter-trend rallies are likely, but they should be viewed as tactical rather than structural. Narrow leadership, compressed volatility, and deteriorating participation all argue against sustained upside at this stage.

This assessment does not negate the long-term investment case for Bitcoin as a scarce, global, digital asset. It reflects only the current cyclical and liquidity regime. Until liquidity expands and participation resets, capital preservation, selectivity, and patience remain the prudent course.

Disclaimer: This statement does not constitute financial advice. The information provided is for informational purposes only and should not be considered as investment advice. If you require financial advice, please consult with our certified financial consultants who can offer personalized guidance based on your specific financial situation.

#melt-up #boom #crack-up #inflation